Structured credit for your business, independent and viable.

Connecting transactions from R$ 20 to R$ 200 million with the right investors.

We build credit solutions according to the specific needs of your business or project.

FIDC

Credit Rights Investment Fund

Credit Rights Investment Funds are one of the main financing channels for private credit in Brazil.

At Bamboo DCM, we act in an integrated way: we originate, analyze, structure and distribute FIDCs to qualified and professional investors.

Bamboo Cortex

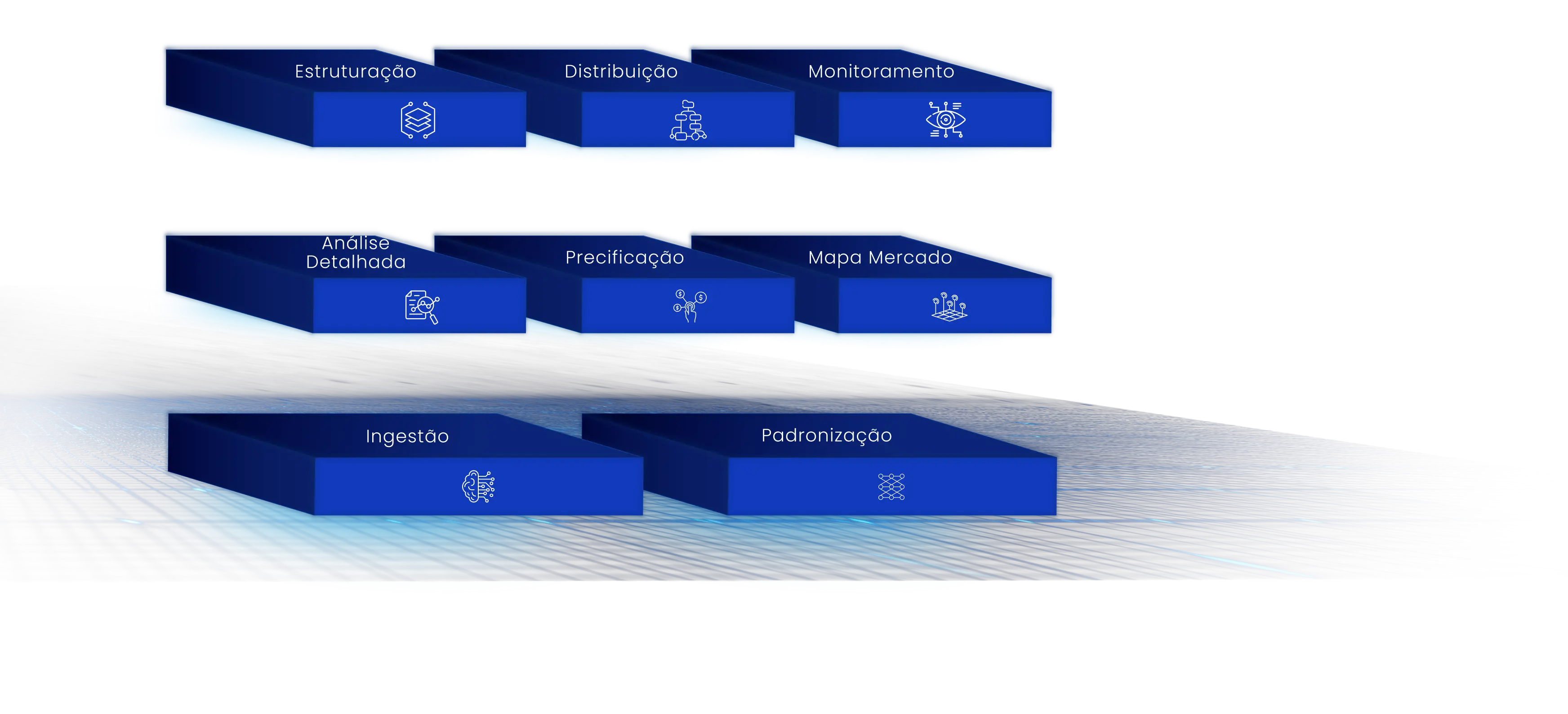

Through our Bamboo Cortex solution, we support your transaction at every stage, from feasibility analysis to the terms and conditions that will ensure a successful fundraising.

Want to receive our insights?

We create solutions for companies and, in doing so, help expand the credit market in Brazil

We operate transparently and independently in transactions

We create value for everyone with applied technology and expertise

We are CVM licensed and adhere to ANBIMA self-regulation