Bamboo DCM Radar

Monitoring the Future of the Market, Now.

An exclusive and strategic content space, focused on providing up-to-date and relevant information about the capital markets.

What Growth-Stage Companies Need to Know About the Credit Market

Brazil's capital markets remain strong and continue to offer significant opportunities, especially for growing companies looking to scale efficiently. Between Q4 2024 and Q1 2025, the volume of debt issuances surpassed R$ 370 billion, signaling a favorable environment for structured credit operations.

But what does this mean in practice for companies in expansion?

In this article, we highlight three essential insights for businesses seeking to access the capital markets with strategic and financial intelligence.

1. Debt issuance volumes remain high and diversified

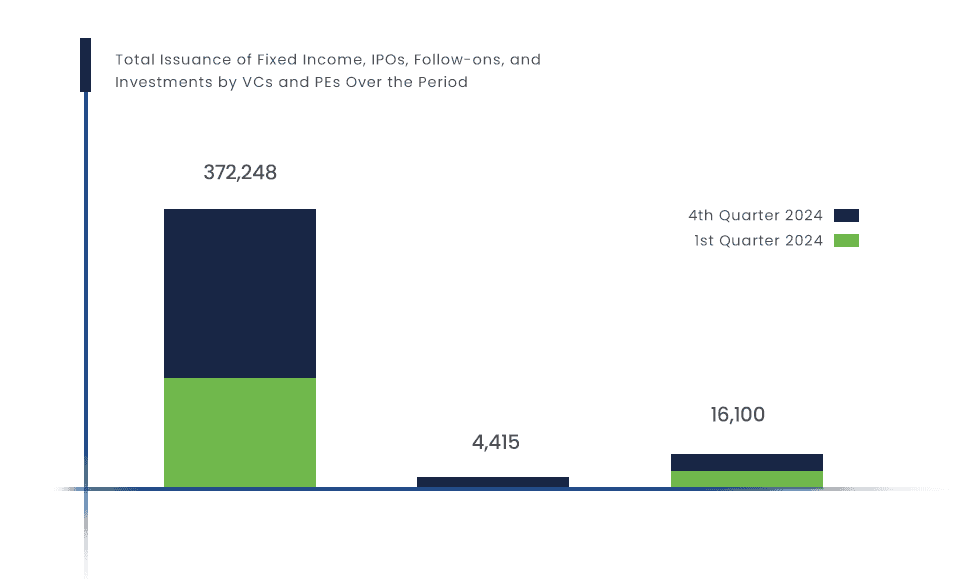

According to ANBIMA, Brazil’s capital markets saw R$ 372 billion in debt issuances over the period. At the same time, IPOs, follow-ons, and investments from Venture Capital (VC) and Private Equity (PE) reached close to R$ 21 billion, showing that companies at different stages continue to pursue a range of capital-raising strategies.

This level of activity reinforces that, even in a higher interest rate environment, the capital markets remain a key avenue for companies looking to finance growth, optimize their capital structure, and diversify funding sources.

2. Market access is not just for large corporations

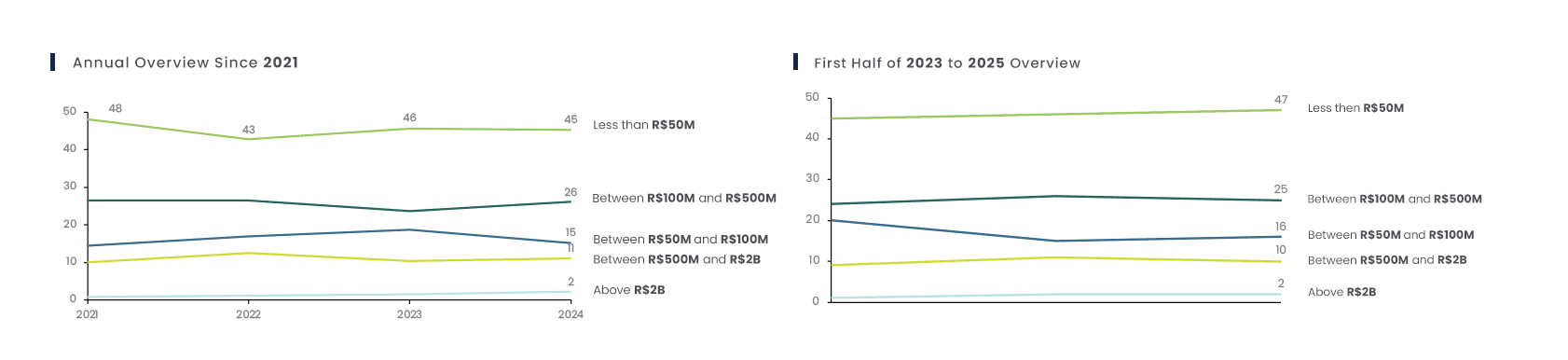

Another key takeaway is the diversity of deal sizes being executed. According to ANBIMA, nearly half of all issuances over recent years were under R$ 50 million, highlighting that the market is far from being restricted to large corporations.

With the right structure and guidance, growing companies can access tailored instruments that align with their current size and trajectory.

3. Capital markets often offer more competitive credit costs

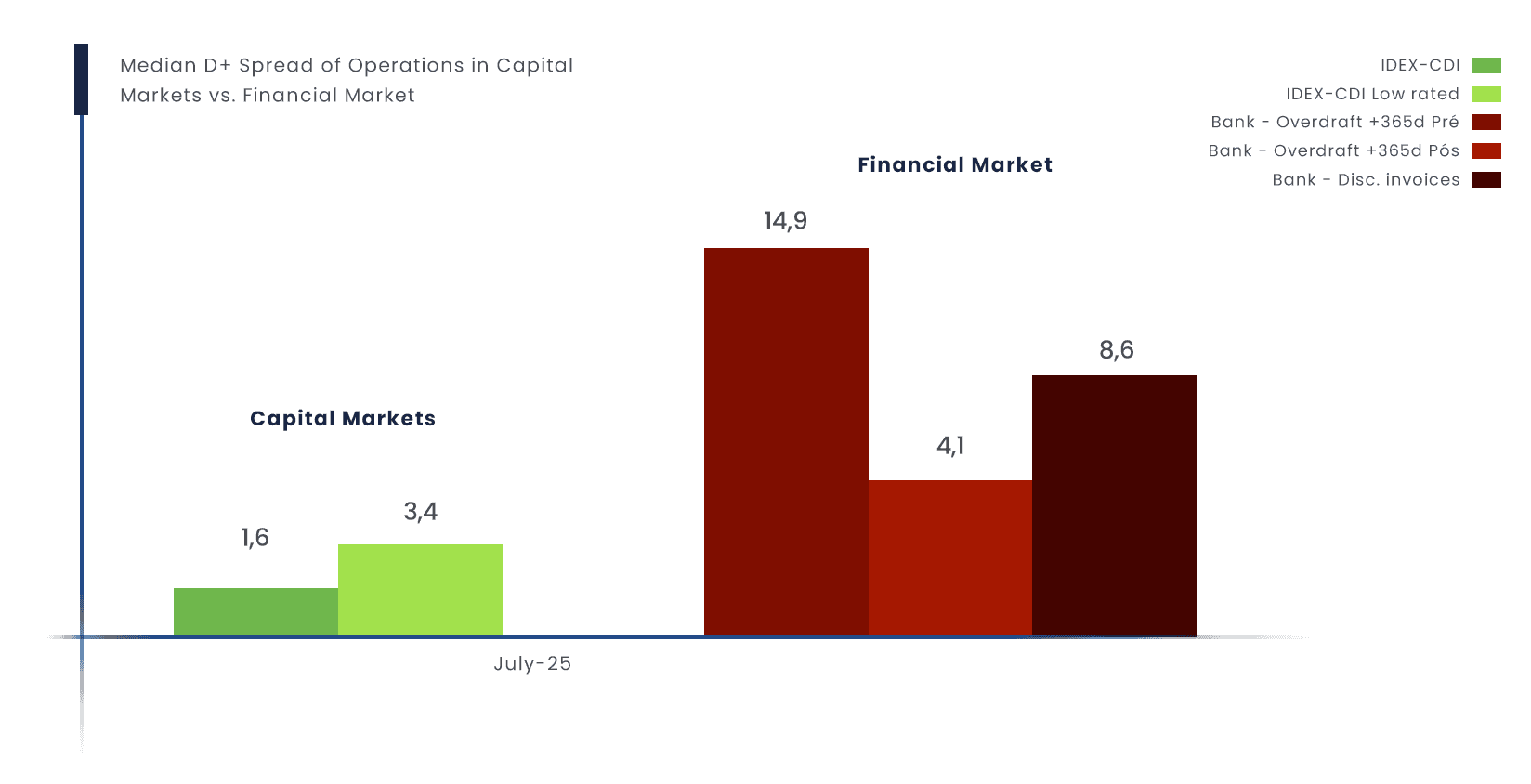

It’s also critical to compare funding costs across different sources. Data from the Brazilian Central Bank and IDEX show that credit costs in the capital markets are often significantly lower than those offered by traditional banks.

While median spreads in capital markets range from 1.6% to 3.4%, some bank lending products, such as long-term working capital loans, can reach 14% or more, depending on the terms and risk profile.

Accessing the market requires preparation and the right strategy

Despite the opportunities, successfully tapping into the capital markets takes more than intent: it requires preparation, a well-structured offer, and the ability to engage with the right investors.

At bamboo DCM, we combine deep market experience with technical expertise to support companies ready to grow with financial intelligence. If your business is entering a new stage of expansion and exploring structured credit, our team is here to help.

Sources: